Today’s Mortgage Rates – PennyMac Loan Services – PennyMac Loan Services is committed to offering its customers a wide range of home loan options to suit a variety of financial needs. Whether you’re a first-time homebuyer , looking to consolidate high-interest debt or wish to invest in real estate , we offer competitive rates and term lengths that make purchasing or refinancing a home.

Chart Of Interest Rates What Is Federal Interest Rate The Federal Interest Rate is Up, How Will This Impact Me. – The federal funds rate is the interest rate banks charge each other to borrow money overnight. Many financial institutions look to the changes in the federal funds rate in order to set their own interest rates.Interest Rates and Fees | Federal Student Aid – What are the interest rates for federal student loans? The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. The table below provides interest rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2018, and before July 1, 2019.

Rates Freddie Mac Today Interest – Commercialofficefurnitureusa – FHFA – Freddie Mac – MBA Mortgage Rates – Mortgage News Daily provides the most extensive and accurate coverage of the mortgage interest rate markets. All. All. FHFA / Freddie Mac / MBA Report Date Current Report. today was a fine day.

Freddie Mac: Mortgage rates now sit at lowest level in. – · As forecasted, mortgage rates continued to drop in the latest Freddie Mac Primary Mortgage Market Survey. And not only did rates drop, but.

Current Mortgage Rates Comparison On July 3, 2019, according to Bankrate’s latest survey of the nation’s largest mortgage lenders, the benchmark 30-year fixed mortgage rate is 3.86 percent.

Freddie Mac Multifamily Loans – Apartment Financing – The Freddie mac hybrid small arm Apartment Loan program fills a gap in the small multifamily loan space ($1MM-$7.5MM) for borrowers seeking competitively priced, non-recourse debt without yield maintenance, or a balloon payment at the end of the fixed term.

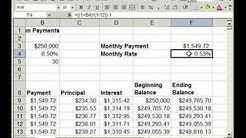

Current National Mortgage Rate Mortgage rate graph 10 years How Do Mortgage Interest Rates Work How Do Credit Scores Affect Mortgage Interest Rates? – · For example, a borrower with a $300,000 mortgage would pay about $1,400 a month at 4 percent interest, versus $1,700 at 5.6 percent. It should be stressed that there are a variety of factors that affect your interest rate besides your credit score.

If you hope to get the best mortgage rates possible, you'll need to make sure. as well as some tips you can use to improve your current standing.Homebuyers Will Like This Mortgage Rates Forecast – · The current average on a 30-year fixed-rate mortgage is unchanged this week at 4.35%, Freddie Mac says. One year ago, the rate was higher than it is today – averaging 4.43%.

Freddie Mac makes money by charging a guarantee fee on its purchased loans that have been bundled, or securitized, into mortgage-backed securities (MBS) that provide investors with interest income.

· Freddie Mac lowers the interest rates on the mortgages you get from the bank. In fact, it estimates it lowers the rate 0.5 percent, which translates to a $12,000 over the life of a $100,000 loan.

Along with Freddie Mac, which was established in 1970, Fannie Mae buys mortgages from banks and makes sure the banks don’t run out of money, and, in turn, can offer more mortgages.

30 Year Fixed Mortgage Rates Texas Mortgage 30 year fixed rates – Mortgage 30 Year Fixed Rates – Save money and time by refinancing your loan online. Visit our site to view your personalized rate and loan term option. A home mortgage refinance accuracy can also be used to remodel your home or add by adding.

PDF Fixed-Rate Loan – mf.freddiemac.com – With our fixed-rate loan, you get a flexible, streamlined financing solution and certainty of execution for the acquisition or refinance of multifamily housing properties. Borrowers have a variety of options to suit their individual needs. The Freddie Mac Difference When it comes to multifamily finance, Freddie Mac gets it done.

Best 5 Year Mortgage Rates Fannie Mae Current Interest Rates Fannie Mae, Freddie Mac cut mortgage modification interest rate to lowest level of 2017 – For the third time this year, Fannie Mae and Freddie Mac are lowering the benchmark interest rate for standard mortgage modifications. And unlike last time, both of the government-sponsored.Best Mortgage Rates 5-Year Variable – Compare Today’s. – Term: Term The mortgage term is the amount of time a home buyer commits to the rules, conditions and interest rate agreed upon with the lender. The term can be anywhere from six months to 10 years, with a 5-year mortgage term being the most common duration.